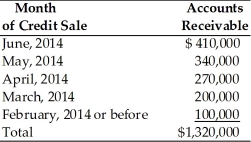

Table 15.6

A breakdown of Teffan, Inc.'s outstanding accounts receivable dated June 30, 2014 on the basis of the month in which the credit sale was initially made follows. The firm extends 30-day credit terms.

-A decrease in collection efforts by a firm will result in ________ in sales volume, ________ in the investment in accounts receivable, ________ in bad debt expenses, and ________ in collection expenditures.

Definitions:

Cheques

Cheques are written, dated, and signed instruments that direct a bank to pay a specific sum of money from the cheque writer's account to the person or entity in whose name the cheque has been issued.

Bank Charges

Bank charges are fees imposed by banks for various services, including account maintenance, transactions, overdrafts, and loan management.

Treasury Bills

Short-term government securities issued at a discount from the face value and mature in a year or less, representing a secure, low-risk investment.

Net Present Value

A valuation method that calculates the present value of expected future cash flows minus initial investment, used to assess investment opportunities.

Q11: A popular extension of materials requirement planning

Q16: The key securities traded in the capital

Q23: Under the floating inventory lien,the borrower is

Q26: The Glass-Steagall Act _.<br>A)was intended to regulate

Q33: A sunk cost is a cash flow

Q54: If a firm anticipates stretching accounts payable,its

Q73: Regularly paying a fixed or increasing dividend

Q102: Relevant cash flows are the incremental cash

Q136: When a firm initiates or increases a

Q175: The optimal capital structure is the one