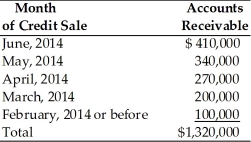

Table 15.6

A breakdown of Teffan, Inc.'s outstanding accounts receivable dated June 30, 2014 on the basis of the month in which the credit sale was initially made follows. The firm extends 30-day credit terms.

-An increase in accounts receivable turnover for a firm due to an increase in collection efforts will ________.

Definitions:

Payroll Taxes

Taxes imposed on employers and employees, calculated as a percentage of the salaries that employers pay their staff.

Taxable Income

The portion of an individual's or corporation's income that is subject to taxation by the government.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, reflecting the percentage of an additional dollar of income that is paid in taxes.

Total Tax

The cumulative amount of taxes paid by an individual or business across all applicable tax categories within a specific period.

Q13: _ involves the sale of accounts receivable.<br>A)Trust

Q33: The market for short-term bank deposits denominated

Q55: Despite the extensive research conducted in recent

Q119: Inventory is more attractive than accounts receivable

Q125: A floating inventory lien is most attractive

Q206: Controlled disbursing is a method of consciously

Q237: In the ABC system of inventory management,the

Q287: What is the cost of the marginal

Q295: Ashley's Ad Agency's accounts receivable totaled $451,000

Q311: Too much investment in current assets reduces