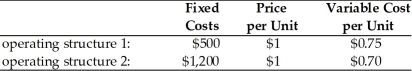

China America Manufacturing is evaluating two different operating structures which are described below.The firm has annual interest expense of $250,common shares outstanding of 1,000,and a tax rate of 40 percent.  (a)For each operating structure,calculate

(a)For each operating structure,calculate

(a1)EBIT and EPS at 10,000,20,000,and 30,000 units.

(a2)the degree of operating leverage (DOL)and degree of total leverage (DTL)using 20,000 units as a base sales level.

(a3)the operating breakeven point in units.

(b)Which operating structure has greater operating leverage and business risk?

(c)If China America projects sales of 20,000 units,which operating structure is recommended?

Definitions:

Diaphragm

A large, dome-shaped muscle located at the base of the lungs and thoracic cavity that contracts and relaxes to aid in the breathing process by creating a vacuum that pulls air into the lungs.

Elastic Properties

Characteristics of materials that allow them to stretch and return to their original shape without permanent deformation.

External Intercostal Muscles

The External Intercostal Muscles are a group of muscles found between the ribs that aid in the process of inhalation by elevating the ribcage, expanding the thoracic cavity.

Pleural Cavity

The thin fluid-filled space between the two pulmonary pleurae of each lung, involved in respiratory mechanics.

Q6: Conflicting rankings in the case of mutually

Q24: Thinking in terms of the goal of

Q35: The amount of leverage in a firm's

Q71: Due to a clientele effect,Modigliani and Miller

Q74: A dividend reinvestment plan enables stockholders to

Q90: Poor capital structure decisions can result in

Q124: In capital budgeting,risk is generally thought of

Q126: By purchasing shares through a firm's dividend

Q156: The probability that a firm will become

Q226: _ are established to evaluate a customer's