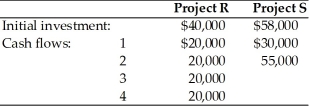

A firm is evaluating two mutually exclusive projects that have unequal lives.The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select.The firm's cost of capital has been determined to be 14 percent,and the projects have the following initial investments and cash flows:

Definitions:

Learning Organizations

Companies or entities that prioritize, facilitate, and continuously adapt through the learning of its members, promoting innovation and responsiveness to changing environments.

Learning Organizations

Learning Organizations are companies that facilitate the learning of their members and continuously transform themselves to adapt and innovate in a rapidly changing environment.

Profitability

A financial metric that measures the degree to which a business or activity yields profit or financial gain, often expressed as a ratio of net income to sales.

Hyper-Turbulent Environment

An extremely unstable or rapidly changing environment in which businesses operate.

Q5: Both levered and unlevered properties are included

Q6: A firm's capital structure is the mix

Q9: The investment rating for mortgage-backed bonds depends

Q19: When considering a firm's financial decision alternative,financial

Q31: During the period before a fund manager

Q48: _ leverage is concerned with the relationship

Q70: Business risk is the risk that is

Q85: Mark must buy four new tires for

Q100: A preferred approach for risk adjustment of

Q170: Breakeven analysis is used by a firm