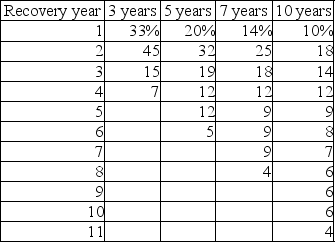

-A corporation is evaluating the relevant cash flows for a capital budgeting decision and must estimate the terminal cash flow. The proposed machine will be disposed of at the end of its usable life of five years at an estimated sale price of $2,000. The machine has an original purchase price of $80,000, installation cost of $20,000, and will be depreciated under the five-year MACRS. Net working capital is expected to decline by $5,000. The firm has a 40 percent tax rate on ordinary income and long-term capital gain. The terminal cash flow is ________.

Definitions:

Taxable Account

An investment account in which the earnings are subject to income tax.

Compounded Quarterly

The process of adding interest to the principal sum of a loan or deposit, calculated every three months.

Mortality Table

A statistical table showing the rate of death at each age, used by insurers to calculate premiums and by actuaries for statistical assessments.

Life Insurance Policies

Contracts with an insurance company in which the company pays a designated beneficiary a sum of money upon the death of the insured person.

Q27: It is difficult to compare the investment

Q55: Dividends are the only means by which

Q64: In the traditional approach to capital structure,as

Q110: _ are the standards of conduct or

Q113: An increase in fixed operating costs will

Q121: In general,the greater the difference between the

Q126: A firm has arranged for a lockbox

Q138: An approach to capital rationing that involves

Q182: _ analysis is a technique used to

Q193: What is the net result of increasing