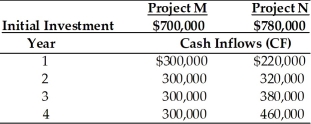

Table 11.8

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below.Tangshan Mining's overall cost of capital is 15 percent,the market return is 15 percent and the risk-free rate is 5 percent.Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation,the NPV for Project M is ________.(See Table 11.8)

Definitions:

Comparative Financial Statement

Comparative financial statements present the financial position and results of operations for a business across multiple periods, allowing for analysis of trends and financial performance over time.

Base Period

A specific time period against which conditions in other time periods are compared, often used in index numbers or to measure economic growth.

Estimated Period

A time frame within which certain financial projections or the useful life of an asset is expected to occur.

Vertical Analysis

A financial method that expresses each item in a financial statement as a percentage of a base figure from the same statement, typically used for income statements and balance sheets.

Q3: Joint ventures typically involve a large number

Q9: Consider an investment held over three years

Q17: Modigliani and Miller suggest that the value

Q19: Investments that are held "in trust" on

Q25: The purpose of a reverse stock split

Q33: A firm has just ended its calendar

Q86: A firm's _ is the level of

Q86: The payment date is five days after

Q87: The higher the financial breakeven point and

Q115: Paying a stock dividend _.<br>A)decreases the retained