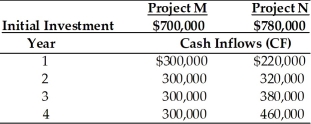

Table 11.8

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below.Tangshan Mining's overall cost of capital is 15 percent,the market return is 15 percent and the risk-free rate is 5 percent.Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation,the NPV for Project N is ________.(See Table 11.8)

Definitions:

South Dakota

A state located in the Midwestern region of the United States, known for landmarks like Mount Rushmore.

Texas

A state located in the southern region of the United States, known for its large size and diverse landscapes.

Sedimentary Cycle

Biochemical cycle such as the phosphorus cycle, in which the atmosphere plays little role and rocks are the major reservoir.

Carbon Cycle

Biogeochemical cycle in which carbon is exchanged between oceans, soils, atmosphere, and living organisms.

Q5: According to the residual theory of dividends,if

Q54: Total leverage can be defined as the

Q66: Corporate governance refers to _.<br>A)the rules,processes,and laws

Q72: An effective ethics program _.<br>A)can weaken corporate

Q86: The cash flow pattern for the capital

Q97: The EBIT-EPS approach to capital structure involves

Q119: Over many years,share repurchases have accounted for

Q132: Calculate the tax effect from the sale

Q144: Holding all other factors constant,a firm that

Q167: The annualized NPV of Project B is