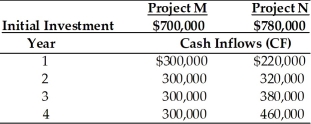

Table 11.8

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below.Tangshan Mining's overall cost of capital is 15 percent,the market return is 15 percent and the risk-free rate is 5 percent.Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation,the better investment for Tangshan Mining is ________.(See Table 11.8)

Definitions:

Buyers and Sellers

Participants in a market where buyers exchange money for goods or services provided by sellers.

Market Prices

The existing rate at which one can buy or sell an asset or service.

Profit-Seeking

The motivation or strategy of businesses and individuals to increase their financial gains or profits.

Property Rights

Legal rights to use, manage, and obtain benefits from a resource, property, or invention.

Q3: Which of the following is a routine

Q3: Which of the following statements regarding subprime

Q3: The NCREIF Property Index can be characterized

Q25: A REIT has an NOI of $15

Q36: Stockholders expect to earn higher rates of

Q105: The primary purpose of a stock split

Q107: With regard to dividend payments,which of the

Q109: Regular dividend policy is a dividend policy

Q198: The degree of operating leverage will increase

Q204: If a firm's fixed financial costs decrease,the