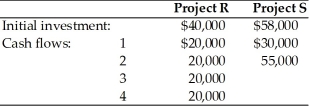

A firm is evaluating two mutually exclusive projects that have unequal lives.The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select.The firm's cost of capital has been determined to be 14 percent,and the projects have the following initial investments and cash flows:

Definitions:

Q3: When pricing mortgage pass-through securities,issuers use each

Q5: A limited partnership limits the general partners'

Q13: The CMO is a considered a marketing

Q20: If the NPV is greater than $0,a

Q21: The clientele effect refers to _.<br>A)the relevance

Q64: The tax treatment regarding the sale of

Q80: A corporation is selling an existing asset

Q81: The book value of the existing asset

Q106: Tangshan Mining has common stock at par

Q106: Under which of the following legal forms