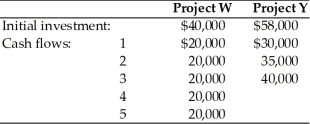

A firm is evaluating two mutually exclusive projects that have unequal lives.The firm must evaluate the projects using the annualized net present value approach and recommend which project they should select.The firm's cost of capital has been determined to be 18 percent,and the projects have the following initial investments and cash flows:

Definitions:

MRP II

Manufacturing Resource Planning, an integrated method of operational and financial planning for manufacturing companies, expanding beyond Material Requirements Planning (MRP).

Enterprise Resource Planning

A type of software that organizations use to manage day-to-day business activities such as accounting, procurement, project management, risk management and compliance, and supply chain operations.

Master Production Schedule

A detailed plan that outlines when and how much of each product will be produced over a certain period.

Q2: For which of the following investments is

Q14: Which of the following is a major

Q18: An optional delivery commitment,gives Fannie Mae the

Q22: The tax liability of a sole proprietorship

Q23: Opportunity funds are designed for long-term investment

Q39: Financial managers evaluating decision alternatives or potential

Q82: The lower risk nature of long-term debt

Q87: The higher the financial breakeven point and

Q113: According to the bird-in-the-hand argument,current dividend payments

Q161: Which of the following is TRUE of