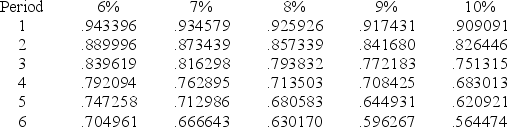

Using only the information in the table below,what would the IRR be for an investment that cost $500 in period 0 and was sold for $750 in period 5? Present Value Factor for Reversion of $1

Definitions:

Macrophage

A type of white blood cell that engulfs and digests cellular debris, foreign substances, microbes, and cancer cells.

Connective Tissue

A type of tissue in the body that supports, connects, or separates different types of tissues and organs, comprised of cells, fibers, and extracellular matrix.

Monocyte

A type of white blood cell that plays a key role in immune defense, capable of differentiating into macrophages and dendritic cells.

White Blood Cell Count

A measure of the number of white blood cells present in the blood, an important indicator of immune function or infection.

Q19: Which of the following common contingencies is

Q22: Which of the following is not a

Q24: Which of the following is an example

Q32: Which lease has the LOWEST effective rent?

Q33: A _ is created to guide and

Q34: What are some of the ways to

Q34: The price a potential tenant must pay

Q38: Describe the differences between general and specific

Q40: Why do many fraud cases go unreported

Q49: Which of the following is the greatest