Use the information for the question(s) below.

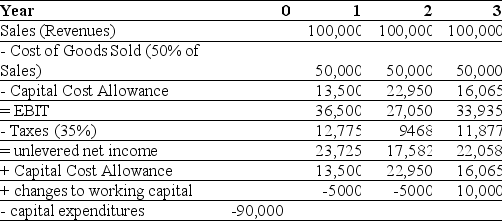

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projects:

-The free cash flow for the first year of Epiphany's project is closest to:

Definitions:

Sales Discounts

A reduction in the price of goods or services offered by a seller to encourage prompt payment by the buyer.

Q4: CathFoods will release a new range of

Q6: 4-17 A best-efforts offering of a security

Q13: 1-62 The asset transformation function of FIs

Q17: 1-1 Prior to the financial crisis of

Q34: A company buys tracking software for its

Q37: 2-65 By late 2009,the number of commercial

Q49: A Government of Canada zero-coupon bond has

Q63: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" The table above

Q71: 3-83 Calculate the annual cash flows of

Q83: Given the cash flows in the table