Use the information for the question(s) below.

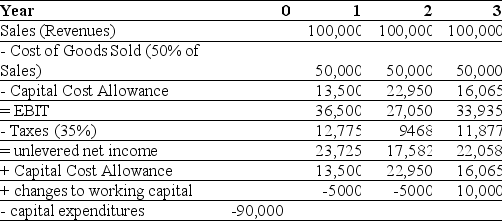

Epiphany Industries is considering a new capital budgeting project that will last for three years.Epiphany plans on using a cost of capital of 12% to evaluate this project.Based on extensive research,it has prepared the following incremental cash flow projects:

-The free cash flow for the last year of Epiphany's project is closest to:

Definitions:

Bad Debt Expense

An expense recognized when a company determines that a customer's debt is no longer collectible.

Cash Realizable Value

The amount of money that could be realized from assets if they were sold, after settling any associated costs.

Allowance Method

The allowance method is an accounting technique that enables companies to anticipate and adjust for expected bad debts or credit losses in their financial statements.

Direct Write-off Method

Accounting practice where uncollected receivables are directly written off against income when deemed uncollectible, without using an allowance account.

Q18: The present value (PV)of the lease payments

Q28: A firm is considering investing in a

Q54: 4-57 Offering bank deposit-like accounts to individual

Q61: What rating must Luther receive on these

Q68: 3-82 You start an annuity with $1million

Q68: 2-2 Most of the change in the

Q80: 4-31 The largest source of funding for

Q87: Assuming that your capital is constrained,which project

Q89: Why does capital budgeting focus on incremental

Q129: A florist is buying a number of