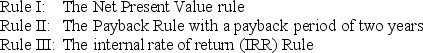

Mary is in contract negotiations with a publishing house for her new novel.She has two options.She may be paid $100,000 up front,and receive royalties that are expected to total $26,000 at the end of each of the next five years.Alternatively,she can receive $200,000 up front and no royalties.Which of the following investment rules would indicate that she should take the former deal,given a discount rate of 8%?

Definitions:

Realistic Conflict Theory

A social psychology theory that suggests intergroup conflicts arise from competition over limited resources.

Prejudice

Preconceived opinion that is not based on reason or actual experience.

Segregation

The enforced separation of different racial groups in a country, community, or establishment.

Prejudice

A preconceived opinion or judgment about someone or something that is not based on reason or actual experience.

Q3: 4-86 How much money does TWResearch receive?<br>A)$

Q6: What is a mortgage?

Q8: Which of the following best describes why

Q11: Assuming that you have made all of

Q33: Joe borrows $100,000 and agrees to repay

Q49: 3-13 The payments from an annuity offered

Q87: Since your first birthday,your grandparents have been

Q89: You decide to take out a car

Q93: Which of the following is TRUE regarding

Q106: What is the yield to maturity of