Use the information for the question(s) below.

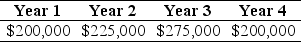

The Sisyphean Company is planning on investing in a new project.This will involve the purchase of some new machinery costing $450,000.The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 16%.

The appropriate discount rate for this project is 16%.

-The internal rate of return (IRR) for this project is closest to:

Definitions:

Straight-Line Depreciation

A depreciation method where an asset's cost is evenly distributed over its expected lifespan.

Net Present Value

A financial metric used to evaluate the profitability of an investment, calculated by subtracting the present value of cash outflows from the present value of cash inflows over a period.

Capital Budgeting

The process of making long-term planning decisions for investment projects, evaluating their potential profitability and financial impact.

Straight-Line Depreciation

A method of calculating depreciation by evenly spreading the cost of an asset over its useful life.

Q1: 2-60 A consumer lending function is performed

Q23: The Sisyphean Company's common stock is currently

Q25: What are dividend payments?<br>A)payments made to a

Q33: Joe borrows $100,000 and agrees to repay

Q36: Can we apply the annuity or perpetuity

Q44: 1-31 The efficiency with which FIs provide

Q53: 1-30 Time intermediation involves the investment of

Q81: 4-45 In market-making<br>A)agency transactions are two-way transactions

Q89: 4-56 Participation in the activities relating to

Q118: You have an investment opportunity in Germany