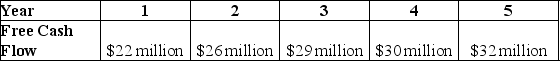

Use the table for the question(s) below.

-General Industries is expected to generate the above free cash flows over the next five years,after which free cash flows are expected to grow at a rate of 3% per year.If the weighted average cost of capital is 8% and General Industries has cash of $10 million,debt of $40 million,and 80 million shares outstanding,what is General Industries' expected current share price?

Definitions:

Prior Probabilities

The probabilities of different outcomes or hypotheses as estimated before any new evidence or data is taken into account.

Payoff Table

A decision-making tool that summarizes the various outcomes and their respective rewards or costs for different strategies or decisions.

Expected Monetary Value

The predicted value of a financial transaction, taking into account all possible outcomes weighted by their probabilities.

Perfect Information

A condition in decision-making where all relevant information is known to the decision-maker, including outcomes, events, and consequences for every choice.

Q33: To compute the future value of a

Q37: Which of the following bonds is trading

Q42: 2-38 The Financial Services Modernization Act of

Q52: 1-16 Secondary securities are securities that serve

Q77: 1-44 The proportion of financial assets controlled

Q83: The table above shows the stock prices

Q88: Quality adjustments to changes in the CPI

Q100: How do you apply the Net Present

Q117: Inflation measures:<br>A)how price changes impact interest rates.<br>B)how

Q120: What is the difference between common stock