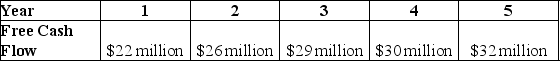

Use the table for the question(s) below.

-General Industries is expected to generate the above free cash flows over the next five years,after which free cash flows are expected to grow at a rate of 3% per year.If the weighted average cost of capital is 8% and General Industries has cash of $10 million,debt of $40 million,and 80 million shares outstanding,what is General Industries' expected terminal enterprise value?

Definitions:

Fugitive

A person who has escaped from capture or is in hiding, often to avoid arrest or persecution.

Valid Argument

A logical sequence of statements where if the premises are true, the conclusion must also be true.

Prejudged

To make a decision or form an opinion about something or someone in advance, without sufficient evidence or through bias.

Worthy of Friendship

A term used to describe individuals or entities that possess qualities making them desirable or valuable as friends.

Q12: Which of the following best explains why

Q15: Suppose that a zero-coupon bond has a

Q17: If your new strip mall will have

Q30: You are considering adding a microbrewery onto

Q39: Matthew wants to take out a loan

Q40: What is the difference between a perpetuity

Q42: How do we handle a situation when

Q44: In terms of present value (PV),how much

Q76: To calculate the future value of an

Q109: A delivery service is buying 600 tires