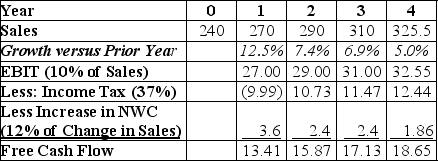

Use the table for the question(s) below.

-Banco Industries expects sales to grow at a rapid rate over the next 3 years,but settle to an industry growth rate of 5% in year 4.The spreadsheet above shows a simplified pro forma for Banco Industries.Banco Industries has a weighted average cost of capital of 12%,$50 million in cash,$60 million in debt,and 18 million shares outstanding.If Banco Industries can reduce their operating expenses so that EBIT becomes 12% of sales,by how much will their stock price increase?

Definitions:

Processing Cost

The total expense incurred to convert raw materials into finished products, including labor, materials, and overhead costs in a manufacturing process.

Differential Analysis

The process of comparing the cost and revenue of different business decisions to determine which option offers the best financial outcome.

Make or Buy

A decision-making process in businesses to determine whether to produce goods internally or purchase them from an external supplier.

Operating Capacity

The maximum output that a company can produce under normal conditions over a specific period of time.

Q10: What is the IRR for this project?<br>A)4.59%<br>B)8.63%<br>C)15.91%<br>D)21.86%<br>E)44.63%

Q11: How much will the coupon payments be

Q14: How can the dividend-discount model handle changing

Q15: The above screen shot from Google Finance

Q19: The above screen shot from Google Finance

Q19: Why is the yield of bonds with

Q95: What is the PV of an investment

Q103: Visby Rides,a livery car company,is considering buying

Q115: The face value of a 30-year coupon

Q124: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" An investor is