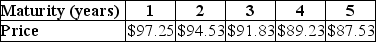

The above table shows the price per $100 face value of several risk-free,zero-coupon bonds.What is the yield to maturity of the three-year,zero-coupon,risk-free bond shown?

The above table shows the price per $100 face value of several risk-free,zero-coupon bonds.What is the yield to maturity of the three-year,zero-coupon,risk-free bond shown?

Definitions:

Trade Name

A term that is used to indicate part or all of a business’s name and that is directly related to the business’s reputation and goodwill. Trade names are protected under the common law (and under trademark law, if the name is the same as the firm’s trademark).

Business's Name

The official legal name under which a company operates and is recognized.

Fanciful Trademarks

Trademarks that consist of invented or fictional words or logos not related to the product or service they represent, offering the strongest level of trademark protection.

Distinctive Trademarks

Trademarks that are unique and recognizable, and capable of distinguishing the goods or services of one enterprise from those of others.

Q5: Should personal preferences for cash today versus

Q9: The present value (PV)of receiving $1000 per

Q18: To evaluate a capital budgeting decision,it is

Q28: A bond with semi-annual coupon payments of

Q29: 1-7 The risk that the sale price

Q31: The internal rate of return (IRR)is the

Q31: What is the difference between cumulative and

Q32: What care,if any,should be taken when cash

Q41: Matilda Industries pays a dividend of $2.25

Q56: Jessica deposits her $2,500 bonus cheque into