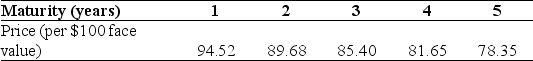

Use the table for the question(s) below.

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of face value) :

-The yield to maturity for the three-year zero-coupon bond is closest to:

Definitions:

Commodity Prices

The market prices for raw materials or primary agricultural products that are traded on exchanges.

Exchange Rates

The value of one currency for the purpose of conversion to another, determining how much one currency is worth in terms of another.

Interest Rates

The cost of borrowing money or the return earned on an investment, usually expressed as a percentage.

Inflation

The rate at which the general level of prices for goods and services is rising, and, consequently, purchasing power is falling.

Q22: Directors who are NOT as directly connected

Q23: Barlow Manufacturing has announced plans to acquire

Q41: The takeover market is characterized by peaks

Q45: If you value a stock using a

Q51: A metal fabrication company is pricing raw

Q53: Explain the difference between a horizontal merger

Q63: Consider the following timeline detailing a stream

Q82: Panjandrum Industries,a manufacturer of industrial piping,is evaluating

Q88: Bond traders generally quote bond yields rather

Q102: Which of the following is the overarching