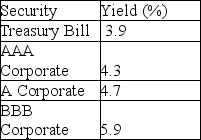

The yields to maturity on a number of one-year,zero-coupon securities are shown in the table above.What is the credit spread on a one-year,zero-coupon corporate bond with an A rating?

The yields to maturity on a number of one-year,zero-coupon securities are shown in the table above.What is the credit spread on a one-year,zero-coupon corporate bond with an A rating?

Definitions:

Firm-Specific Risk

The risk associated with an individual company, which can be reduced through diversification in investment.

Market Risk

The possibility that investors might incur losses because of elements influencing the general performance of the financial markets.

Informationally Efficient

A market condition where all existing information is completely accounted for in stock prices, thereby eliminating the possibility of consistently securing above-average profits.

Random Walk

A statistical theory suggesting that stock market prices evolve according to a random path, making future movements unpredictable based on past trends.

Q2: When the net present value (NPV)of an

Q18: A firm issues ten-year bonds with a

Q28: Liam had an extension built onto his

Q47: Shield Security pays annual dividends and has

Q47: The CCA tax shield for the Sisyphean

Q51: How are interest and return of principal

Q64: A company issues a ten-year $1000 bond

Q68: You are in the process of purchasing

Q71: What is the present value (PV)of $85,000

Q71: Which of the following statements is TRUE?<br>A)A