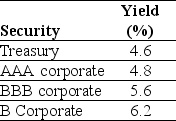

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

- The price (expressed as a percentage of the face value) of a one-year,zero-coupon,corporate bond with a BBB rating is closest to:

The price (expressed as a percentage of the face value) of a one-year,zero-coupon,corporate bond with a BBB rating is closest to:

Definitions:

Monopolists

Single sellers in a market who have significant control over the price and supply of a particular product or service.

Income Redistribution

The governmental policy or action of adjusting the distribution of income, usually through taxation and welfare programs, to achieve a fairer society.

Monopoly Sellers

Single sellers in a market with no close substitutes for the product or service they offer, giving them significant control over prices.

Allocative Inefficiency

A situation where resources are not optimally allocated according to consumer preferences, often leading to overproduction or underproduction of certain goods or services.

Q17: You decide to take out a 25-year

Q33: 1-82 Which of the following is true

Q36: Is it possible to analyze cash flows

Q45: Suppose Alex purchases a 10-year,zero-coupon bond with

Q48: One way for families to gain control

Q50: You are considering an investment opportunity that

Q62: An 8% APR with monthly compounding is

Q78: Your bank account pays monthly interest with

Q94: How can we take a financial decision

Q112: In a trade with the government of