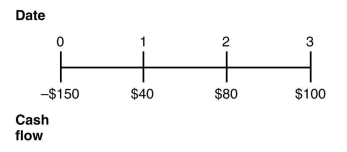

Consider the following timeline:  If the current market rate of interest is 12%,then the value of the cash flows in year 0 and year 2 as of year 1 is closest to:

If the current market rate of interest is 12%,then the value of the cash flows in year 0 and year 2 as of year 1 is closest to:

Definitions:

Informal Economy

Economic activities that are not regulated by the government and often operate outside of official labor market regulations or business practices.

Minimum Wage

The lowest legal amount that an employer is allowed to pay their workers.

Culture

encompasses the beliefs, practices, arts, laws, customs, capabilities, and habits of the people in these societies, shaping their worldview and lifestyle.

Consumer-culture Landmarks

Symbols or icons that are widely recognized within a consumer society, representing key aspects of consumption and consumer identity.

Q12: A $10,000 bond with a coupon rate

Q28: For a lease in which the lessor

Q29: An investor purchases a 30-year,zero-coupon bond with

Q48: A zero-coupon bond with a $1000 face

Q69: You are considering purchasing a new automobile

Q71: A businessman wants to buy a truck.The

Q76: If the current inflation rate is 4%

Q84: Assuming that Luther's bonds receive a AAA

Q85: How can positive cash flow shocks affect

Q117: Prior to its maturity date,the price of