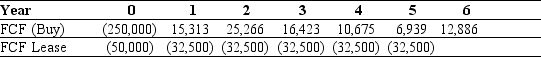

Use the table for the question(s) below.

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

-If your firm's borrowing cost is 7% and the tax rate is 35%,what is the NPV of leasing versus borrowing?

Definitions:

Contribution Margin

The difference between the sales price of a product and its variable costs, used to cover fixed costs and profit.

Sales Mix

The composition of different products or services sold by a company, which can significantly impact profitability based on the varying margins of each item.

Contribution Margin Ratios

The ratio of the contribution margin to sales revenue, expressing the percentage of revenue that contributes to fixed costs and profits after variable costs are covered.

R-Squared

A statistical measure that represents the proportion of the variance for a dependent variable that's explained by an independent variable or variables in a regression model.

Q3: What is an actuarially fair price?

Q17: You are thinking about investing in a

Q36: In addition to the presence of takeover

Q38: The opportunity cost of capital is the

Q40: Consider a case in which existing shareholders

Q43: A Canadian exporter will receive $1.5 million

Q58: A consol bond (perpetual bond)pays $27,500 every

Q84: Why do we compare leasing to borrowing

Q88: A gold mining firm sells futures contracts

Q109: The risk of fire at a car