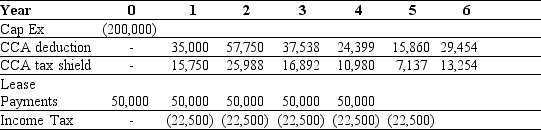

Use the table for the question(s) below.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

Your firm is a lessor that is planning to buy some new equipment and offer it to another firm through a lease arrangement.You have calculated the above cash flows for a potential lease you might offer.

-If your firm's borrowing cost is 3% and the tax rate is 45%,what is the NPV of buying and leasing?

Definitions:

Statement of Financial Position

A financial report that provides a snapshot of a company's assets, liabilities, and equity at a specific point in time.

Noncash Expense

Expenses that do not involve actual cash flow, such as depreciation or amortization.

Statement of Comprehensive Income

A financial statement that displays all changes in equity of a company that arise from non-owner sources during a specific period, including all revenues and expenses.

Terminal Loss

The difference between UCC and the adjusted cost of disposal when the UCC is greater.

Q3: A delivery company is creating a statement

Q4: What is the main reason that it

Q6: What is the difference between an operating

Q22: A firm issues one-month commercial paper with

Q38: When a firm can pass on its

Q47: What are compensating balance and what effect

Q47: Billy,the CEO of Movin On Up Company,was

Q69: What is the present value of the

Q91: The six month LIBOR rate for a

Q107: One way Enron manipulated its financial statements