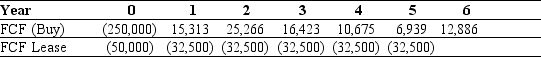

Use the table for the question(s) below.

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

-If your firm's borrowing cost is 10% and the tax rate is 40%,what is the amount of the lease-equivalent loan for the new equipment?

Definitions:

Note Receivable

A financial asset representing a promise to receive a definite amount of money at a future date, typically with interest.

Impaired

A reduction in the recoverable value of an asset below its carrying value on the balance sheet, leading to recognition of an impairment loss.

Market Value

The market value denotes the ongoing rate at which an asset or service can be traded in a marketplace.

Market Value

The present rate at which a service or asset is available for purchase or sale on the open market.

Q6: What is the difference between an operating

Q18: Refer to the income statement above.For the

Q23: Heinz uses 2000 tons of corn syrup

Q34: Consider the following equation: S × <img

Q45: One of the main benefits of leasing

Q49: A firm issues six-month commercial paper with

Q50: Billy,the CEO of Movin On Up Company,was

Q69: You work for a leveraged buyout firm

Q96: _ is the sensitivity of a firm's

Q115: Michael has credit card debt of $60,000