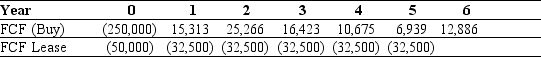

Use the table for the question(s) below.

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

Your firm is contemplating leasing some new equipment.The cash flows of either buying or leasing the equipment are shown in the table above.

-If your firm's borrowing cost is 10% and the tax rate is 40%,what is the NPV of leasing versus borrowing?

Definitions:

E-Mail Messages

Digital forms of communication sent electronically via the internet, commonly used for personal, academic, or professional correspondence.

Conversation Thread

A sequence of messages or comments on a particular subject, displayed together in a cohesive online or electronic dialogue.

Attachment

A file or document that is added to and sent along with an email or other electronic message.

Sender's Name

The name or identity of the individual or entity sending a message, document, or package.

Q7: _ is a person making a trade

Q11: Suppose that the bulldozer can be leased

Q21: Canberry Energy would like to lease an

Q28: Liam had an extension built onto his

Q50: Faisal has $15,000 in his savings account

Q60: Most acquirers pay an acquisition premium for

Q65: Your firm will be importing a large

Q68: You are in the process of purchasing

Q73: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" Consider the above

Q85: How can positive cash flow shocks affect