Use the information for the question(s) below.

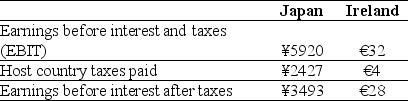

KT Enterprises,a Canadian import-export trading company,is considering its international tax situation.Currently KT's Canadian tax rate is 35%.KT has significant operations in both Japan and Ireland.In Japan,the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%.In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%.KT's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are shown here (in millions) :

-After the Japanese taxes are paid,the amount of the earnings before interest and after taxes in dollars from the Japanese operations is closest to:

Definitions:

Aspirin

A medication used to reduce pain, fever, inflammation, and, in low doses, to prevent blood clots.

Impaired Urinary Elimination

A disruption in the pattern of urination, characterized by an inability to empty the bladder completely or maintain control over urination.

Renal Calculi

Medical term for kidney stones, hard deposits of minerals and salts that form inside the kidneys and can cause pain and urinary issues.

Urinary Tract Infection

An infection in any part of the urinary system, commonly caused by bacteria, and characterized by symptoms like pain during urination.

Q60: Refer to the statement of financial position

Q62: If your firm's borrowing cost is 12%

Q69: Refer to the statement of financial position

Q74: Once a tender offer is announced,the target's

Q81: Genovese Fine Foods,a manufacturer of foodstuffs,buys durum

Q82: What will Luther's balance sheet look like

Q82: What is business liability insurance?

Q88: A lease where the lessee can purchase

Q98: A firm wants to hedge a potential

Q120: Which ratio would you use to measure