Use the information for the question(s) below.

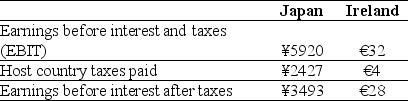

KT Enterprises,a Canadian import-export trading company,is considering its international tax situation.Currently KT's Canadian tax rate is 35%.KT has significant operations in both Japan and Ireland.In Japan,the current exchange rate is ¥118.4/$ and earnings in Japan are taxed at 41%.In Ireland the current exchange rate is $1.27/€ and earnings in Ireland are taxed at 12.5%.KT's profits,which are fully and immediately repatriated,and foreign taxes paid for the current year are shown here (in millions) :

-After the Irish taxes are paid,the amount of the earnings before interest and after taxes in dollars from the Ireland operations is closest to:

Definitions:

Insulin

A hormone produced by the pancreas that regulates glucose levels in the blood, crucial for managing diabetes.

Schizophrenia

A complex, chronic mental health disorder marked by distorted thinking, perceptions, emotions, language, sense of self, and behavior.

Degeneration Theory

A now largely discredited theory that posited that disease and deviance were the result of hereditary degeneration of the genes.

Hereditary Processes

The biological mechanisms by which traits and characteristics are transmitted from parents to their offspring through genes.

Q29: An extremely lucrative severance package that is

Q41: The takeover market is characterized by peaks

Q47: If an arbitrage opportunity exists,an investor can

Q52: Which of the following is one of

Q59: Suppose that Bondi Inc.is a holding company

Q70: Calgary Doughnuts had sales of $200 million

Q78: An operator of an oil well has

Q96: A firm has gross profit of $45

Q98: What is a duration mismatch?

Q98: An investment of $6000 at the start