Multiple Choice

Use the table for the question(s) below.

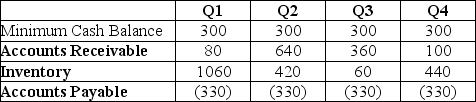

The data above shows the net working capital requirements for Flinder's Camping,a company that makes tents.All figures are in thousands of dollars.

The data above shows the net working capital requirements for Flinder's Camping,a company that makes tents.All figures are in thousands of dollars.

-What can be considered the firm's permanent working capital?

Definitions:

Related Questions

Q8: A lease that is viewed as an

Q13: Heinz uses 2000 tons of corn syrup

Q13: A firm has $10 million in cash,$4.5

Q18: Refer to the income statement above.For the

Q18: Why do purely domestic businesses,with no international

Q26: What can be considered the firm's permanent

Q46: Suppose oil futures prices are as given

Q54: A firm has an average accounts payable

Q61: A firm has ROA of 18%,ROE of

Q95: A provision in an insurance policy that