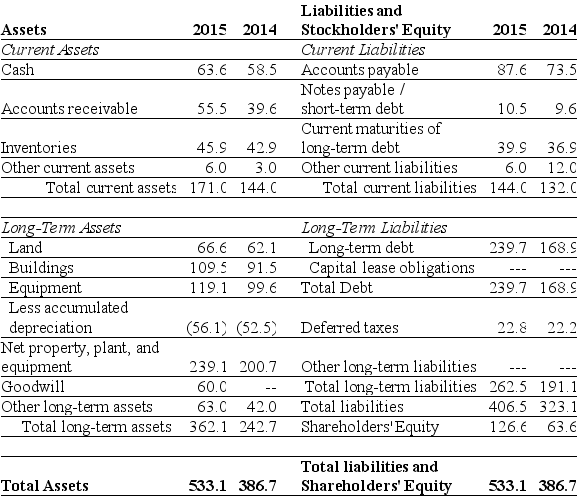

Use the table for the question(s) below.

-Refer to the statement of financial position above.If in 2015 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then Luther's market-to-book ratio would be closest to:

Definitions:

Production Possibilities Curve

A graph that depicts the maximum feasible amounts of two commodities that a business can produce when those commodities compete for limited resources.

Technological Advance

The process of developing new technologies or improving existing ones to increase productivity or solve problems.

Soil Fertility

The ability of soil to provide essential nutrients to plants in adequate amounts for growth.

Overgrazing

The degradation of a grazing land, resulting from livestock grazing at a rate higher than the capacity of the land to regenerate.

Q10: The present value (PV)of the £5 million

Q26: Under perfect capital markets,which of the following

Q28: By combining _ with _,firms can choose

Q35: Which of the following short-term securities would

Q39: What is a margin call?

Q69: What is the present value of the

Q69: A firm has $50 million in equity

Q107: One way Enron manipulated its financial statements

Q110: Based upon Ideko's sales and operating cost

Q110: Which of the following money market investments