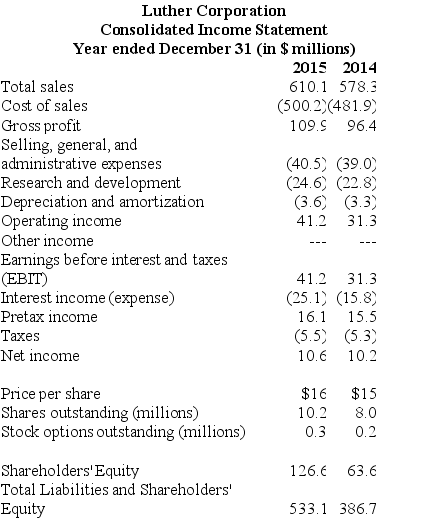

Use the table for the question(s) below.

-Refer to the income statement above.Luther's return on assets (ROA) for the year ending December 31,2015 is closest to:

Definitions:

Rate of Return

The gain or loss on an investment over a specified period, expressed as a percentage of the investment's initial cost.

Investment

Assets or items acquired with the goal of generating income or appreciation in the future.

Annual Effective Rate

The interest rate that is adjusted for compounding over a given period, showing the real return on savings or cost of borrowing.

Nominal Rate

The interest rate or rate of return quoted on a loan or investment, not adjusted for inflation.

Q8: Working capital alters a firm's value by

Q19: How do capital structure choices differ across

Q30: Which of the following is a valid

Q35: If Luther acquires the new fleet of

Q39: The estimate of a firm's value at

Q45: What are the five Cs of Credit?

Q52: The market size for Loppins is 60

Q59: If Luther decides to pay the dividend

Q84: A firm offers its customers 1/7 net

Q103: The amount of the taxes paid in