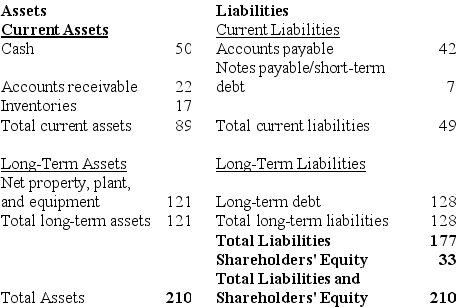

Use the table for the question(s) below.

Statement of Financial Position

-The above diagram shows a statement of financial position for a certain company.All quantities shown are in millions of dollars.How would the balance sheet change if the company's long-term assets were judged to depreciate at an extra $5 million per year?

Definitions:

Fiduciary Duty

An obligation one party (fiduciary) has to act in the best interest of another (the principal) in situations that require trust, honesty, and loyalty.

Compete

To engage in an effort to win or achieve something, such as business or market share, by excelling over others.

Reimbursed

To be reimbursed means to receive repayment for money that has been spent or lost, usually as a result of conducting business or performing tasks on behalf of another.

Apparent Authority

A situation where a person appears to have been given the power to act on behalf of another, even if no actual authority was granted.

Q4: What is covered interest parity?

Q47: LG Inc.has done a long-term forecast of

Q59: Ivanhoe Energy Inc has 36 million shares

Q64: Even if two firms operate in the

Q70: Calgary Doughnuts had sales of $200 million

Q77: Consider two firms,Bob Company and Cat Enterprises,both

Q83: A services firm does all its business

Q91: All investors in the developed and developing

Q100: With perfect capital markets,the total value of

Q103: A firm's net profit margin increased from