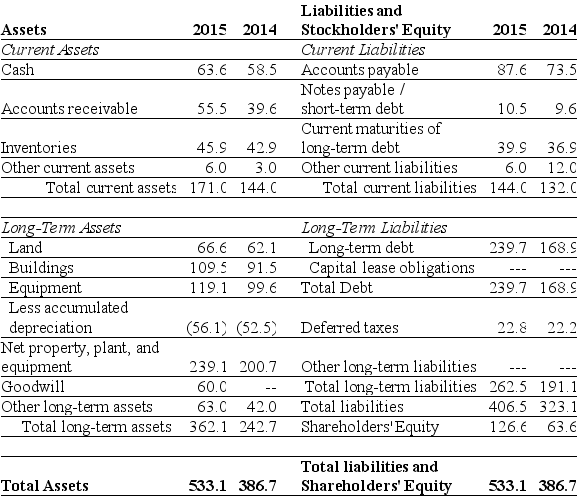

Use the table for the question(s) below.

-Refer to the statement of financial position above.If in 2015 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share,then what is Luther's enterprise value?

Definitions:

Central Nervous System

The part of the nervous system that consists of the brain and spinal cord, responsible for integrating sensory information and responding accordingly.

Depressant

A substance that reduces the functional or nervous activity, often used to describe drugs that inhibit the central nervous system, leading to sedation or relaxation.

Alcohol

A psychoactive substance commonly found in beverages like beer, wine, and spirits, known for its intoxicating effects.

Central Nervous System

The part of the nervous system consisting of the brain and spinal cord, responsible for processing and transmitting information in the body.

Q10: What will be the effect on the

Q44: With the proper changes it is believed

Q63: A lease in which the lessor borrows

Q71: Which of the following is considered an

Q73: A firm had sales of $8 million,and,on

Q78: An operator of an oil well has

Q96: _ is the sensitivity of a firm's

Q99: What are the three reasons why a

Q114: How does a firm select the date

Q116: Bercraft Industries has an average accounts payable