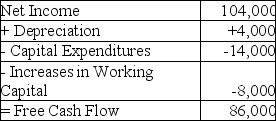

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 6% per year.If Monroe were able to reduce its annual increase in working capital by 15% without affecting any other part of the business adversely,what would be the effect of this reduction on Monroe's value,given a cost of capital of 11%?

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 6% per year.If Monroe were able to reduce its annual increase in working capital by 15% without affecting any other part of the business adversely,what would be the effect of this reduction on Monroe's value,given a cost of capital of 11%?

Definitions:

True Thoughts

Genuine or authentic reflections, beliefs, or considerations held by an individual.

Blind Pane

The pane in the Johari Window that contains everything other people can see about you, but you can’t see yourself.

Johari Window

A model that is used to improve understanding between individuals within a group. It represents self-awareness and mutual understanding among individuals.

Managerial Grid

A framework for analyzing leadership styles by evaluating managers' concern for people versus their concern for production goals.

Q4: What is the main reason that it

Q4: A gold mining firm sells futures contracts

Q26: ABX corporation had sales of $47.6 million

Q26: A bond issue that does NOT trade

Q43: To protect the firm against the loss

Q44: A firm has $400 million of assets

Q75: A manufacturer of breakfast cereal is concerned

Q79: What role do external auditors play in

Q85: Assuming that Ideko has a EBITDA multiple

Q86: What is the amount of Canadian taxes