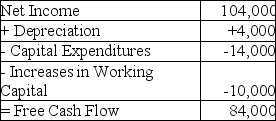

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 4% per year.and has a cost of capital of 8%.Monroe wishes to achieve a 5% increase in firm value.If the rest of the business remains unchanged,what reduction in working capital increases would Monroe require in order to achieve this goal?

Monroe Electronics' projected net income and free cash flows are given above in thousands of dollars.Monroe expects their net income and increases in net working capital to increase by 4% per year.and has a cost of capital of 8%.Monroe wishes to achieve a 5% increase in firm value.If the rest of the business remains unchanged,what reduction in working capital increases would Monroe require in order to achieve this goal?

Definitions:

Financial Data

Critical quantitative information about financial performance, including revenue, expenses, and profitability of an organization.

Return on Investment

A financial metric that calculates the profitability ratio from an investment, comparing the magnitude and timing of gains received to the cost of investment.

Sales Revenues

The total revenue a company earns from selling goods or services prior to deducting any costs.

Implementation Section

A portion of a plan or report that outlines the steps, timelines, and resources necessary to execute the planned activities or strategies.

Q4: A firm requires an investment of $100,000,financed

Q8: Equity-debt holder conflicts are more likely to

Q19: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" Suppose oil futures

Q34: The change in behaviour that results from

Q48: The temporary working capital needs for Hasbeen

Q68: What are internationally integrated capital markets?

Q72: A bond issued by a local (municipal)government

Q83: What are direct costs of financial distress?

Q84: A firm offers its customers 1/7 net

Q121: The amount of the increase in net