Use the information for the question(s) below.

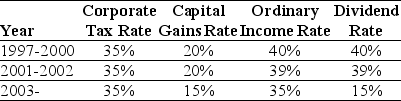

Consider the following tax rates:

-In 2006,Luther Incorporated paid a special dividend of $5 per share for the 1 million shares outstanding.If Luther has instead retained that cash permanently and invested it into Treasury bills earning 6%,then the present value (PV) of the additional taxes paid by Luther would be closest to:

Definitions:

Extrinsic Motivation

Motivation driven by external rewards such as money, fame, grades, or praise, rather than personal satisfaction or interest.

Intrinsic Motivation

The drive to engage in an activity for its own sake and for personal satisfaction, rather than for some external reward.

Rewarding Act

An action that is positively reinforced, leading to the likelihood of the behavior occurring again in the future.

Human Behavior

The range of actions and mannerisms exhibited by humans in conjunction with their environment or social norms.

Q26: ABX corporation had sales of $47.6 million

Q42: Your firm purchases $100,000 worth of goods

Q51: Which of the following is a notable

Q59: Tangible Technologies has a market capitalization of

Q72: A firm had sales of $32 million,and,on

Q74: A firm should choose to borrow using

Q94: Gencom International has inventory days of 12,and

Q98: The open interest for a January 2011

Q111: A firm's credit terms specify "1/10 net

Q115: Which of the following best describes just-in-time