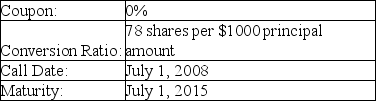

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $14.40.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $14.40.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

Definitions:

Cash Discounts

are reductions in price offered to buyers as an incentive for early payment of their bills, used to improve cash flow.

No-Doubt Security Products

Security products or solutions that offer undeniable protection and reliability, leaving no room for uncertainty or risk.

2/10 Net 30

A common payment term indicating that a buyer can take a 2% discount on the invoice price if payment is made within 10 days; otherwise, the net (full) amount is due within 30 days.

Trade Discount

A reduction in the listed price of goods or services provided by the seller to those in the same trade or industry.

Q28: The amount of net working capital for

Q33: You expect General Motors (GM)to have a

Q44: The founder of a company currently holds

Q60: Compute the value of a firm with

Q63: What is the effective annual cost of

Q74: The volatility of a portfolio that is

Q89: Financial managers prefer to choose the same

Q92: Which of the following is closest to

Q95: When computing the cost of capital:<br>A)Firms with

Q105: Gepps Cross Industries issues debt with a