Multiple Choice

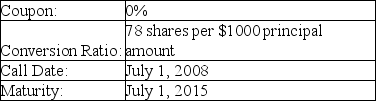

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $14.40.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

A firm issues the convertible debt shown above.The price of stock in this company on July 1,2008 is $14.40.What is the minimum call price that would make a bondholder prefer to accept the call rather than convert?

Definitions:

Related Questions

Q3: The _ is the total number of

Q9: The price of a share of JRN's

Q12: The amount of net working capital for

Q16: Suppose you had sold the 1 million

Q38: A firm has average accounts receivable of

Q43: When a callable bond sells at a

Q51: A firm has an EBITDA forecast of

Q69: What is greenmail?

Q100: With perfect capital markets,the total value of

Q104: What is the implied assumption in percent