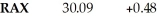

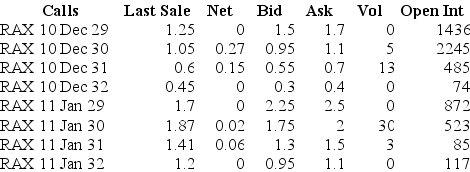

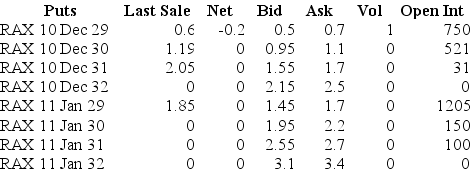

Use the table for the questions below

Consider the following information on options from the CBOE for Rackspace.

-Assume you want to sell 20 call option contracts with an exercise price closest to being at-the-money and that expires January 2011.The current price that you would receive for such a contract is:

Definitions:

Attachment Jurisdiction

The legal authority courts have to seize a defendant's property within its territory to secure jurisdiction over a lawsuit or to satisfy a judgment.

Reply

A response by the plaintiff to the defendant’s counterclaim.

Pleading

A formal written statement submitted by parties in a legal proceeding detailing their claims or defenses.

Case-Or-Controversy

A legal requirement under the Constitution that ensures federal courts only hear actual, ongoing disputes.

Q9: Suppose you buy 100 shares of RBC

Q14: A firm requires an investment of $20,000

Q17: The relative proportions of debt,equity,and other securities

Q23: The proceeds from the IPO be if

Q25: What is a call option?

Q37: A firm has $2 million market value

Q72: What is the free cash flow to

Q77: Newly listed firms tend to perform relatively

Q78: Assume that you own 2500 shares of

Q85: Blackberry stock has a beta of 1.7.If