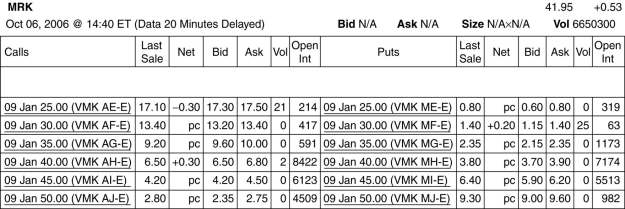

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-Assume you want to buy one options contract with an exercise price closest to being at-the-money and that expires January 2009.The current price that you would have to pay for such a contract is:

Definitions:

Machine Hours

Machine Hours represent a measure of the amount of time a machine is operated, used in costing, and operational efficiency analysis.

Over/Underapplied Overhead

The difference between the actual overhead costs incurred and the overhead costs allocated to production, indicating whether the allocated amount was too high or too low.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including material and labor expenses.

Net Income

Net income, or net profit, is the total earnings of a company after subtracting all expenses, taxes, and costs from total revenue.

Q1: Characteristics of crowdfunding include:<br>A)Raising funds from a

Q13: The payoff to the holder of a

Q22: Epiphany is an all-equity firm with an

Q25: The S&P 500 index traditionally is a

Q28: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" A firm issues

Q29: According to MM Proposition I,the stock price

Q61: Which of the following statements concerning the

Q98: Stocks that have a higher volatility will

Q105: An all-equity firm produced a dividend flow

Q118: XYZ has no excess cash and a