Use the table for the question(s) below.

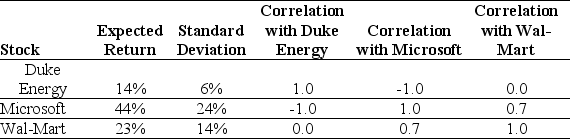

Consider the following expected returns,volatilities,and correlations:

-The expected return of a portfolio that consists of a long position of $10,000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Intellect Motive

A drive to engage in mental activities and challenges that are expected to enrich one's knowledge or understanding.

Thematic Apperception Test

A projective psychological test involving the presentation of ambiguous images to a subject, who is asked to tell a story about each image.

Motives

Internal processes that energize, direct, and sustain behavior toward achieving a particular goal or fulfillment.

Crystallized Intelligence

A form of intelligence that involves the ability to use learned knowledge and experience.

Q16: Which of the following is typically the

Q19: Which of the following statements regarding angel

Q37: A firm has $2 million market value

Q46: Tompkinson's PLC,a British company,issues a bond in

Q52: A firm has $30 million of common

Q56: Assume that a statement of cash flows

Q74: Your investment over one year yielded a

Q77: The following data is provided for last

Q108: Which of the following will increase the

Q126: The dividend yield is calculated as:<br>A)dividends per