Use the table for the question(s) below.

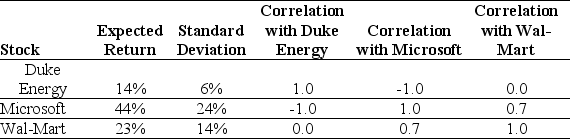

Consider the following expected returns,volatilities,and correlations:

-The volatility of a portfolio that is consists of a long position of $10,000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Contribution Format

A type of income statement format that separates fixed costs from variable costs to highlight the contribution margin.

Income Statement

A financial report that shows a company’s revenues, expenses, and net income over a specific period, illustrating the company’s financial performance.

Reconcile

A process of ensuring two sets of records (usually the balances of two accounts) are in agreement.

Variable Costing

A cost accounting method that encompasses solely variable costs involved in production (direct materials, direct labor, and variable manufacturing overhead) for product cost calculation.

Q1: Ford Motor Company had realized returns of

Q24: In most corporations the owners exercise direct

Q27: The _ of a firm's debt can

Q27: Using the above information,how much would you

Q29: A firm has $50 million of common

Q42: ABX corporation stock is currently trading for

Q51: What is the difference between systematic and

Q59: Tangible Technologies has a market capitalization of

Q87: The standard deviation for the return on

Q113: The declaration of dividends by the board