Use the table for the question(s) below.

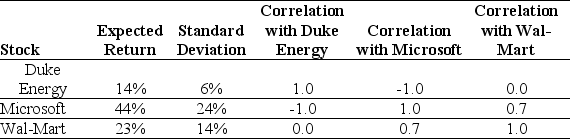

Consider the following expected returns,volatilities,and correlations:

-The expected return of a portfolio that is equally invested in Duke Energy and Microsoft is closest to:

Definitions:

Utility Function

A mathematical model in economics that represents how different quantities of goods or services can provide satisfaction to consumers.

Income

The reward garnered over time, generally in a consistent pattern, from occupational or investment sources.

Expected Utility Function

A concept in economics that predicts the utility or satisfaction a rational individual expects to receive from different outcomes, used in decision making under uncertainty.

Sure Payment

A guaranteed payment, often referring to financial transactions where the payer is obligated to pay a certain amount.

Q4: Windsor Windows earns $4.50 per share before

Q18: Suppose a stock is currently trading for

Q33: Why do most people launching a start-up

Q42: Which of the following is an advantage

Q47: Which of the following two items is

Q49: What kind of corporate debt can be

Q53: Which of the following best describes an

Q74: Your investment over one year yielded a

Q75: The volatility on Home Depot's returns is

Q126: The dividend yield is calculated as:<br>A)dividends per