Multiple Choice

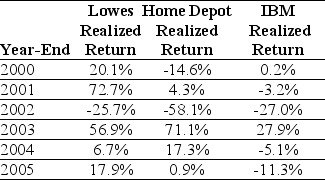

Use the table for the question(s) below.

Consider the following returns:

-The volatility on Lowes' returns is closest to:

Definitions:

Related Questions

Q15: What portion of the company will be

Q31: Assume JUP has debt with a book

Q36: Streyna Company reported net sales of $95,000

Q42: What diversification,if any,is achieved if two stocks

Q56: The under-investment problem refers to the problem

Q68: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6725/.jpg" alt=" Felicity Industries is

Q68: Luther Industries is currently trading for $27

Q79: The binomial option pricing model calculates the

Q91: When the returns of two stocks are

Q97: Cash received from the issuance of bonds