Use the table for the question(s) below.

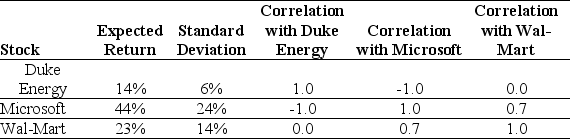

Consider the following expected returns,volatilities,and correlations:

-The volatility of a portfolio that is equally invested in Duke Energy and Microsoft is closest to:

Definitions:

Direct Write-Off Method

An accounting method where bad debts are written off as an expense only when they are deemed to be uncollectable.

Bad Debt Expense

The estimated amount of credit sales that a company does not expect to collect due to customer's inability to fulfill payment obligations.

Uncollectible

Financial term referring to accounts receivable that are considered unlikely to be collected due to debtor default.

GAAP

Generally Accepted Accounting Principles; a collection of commonly-followed accounting rules and standards for financial reporting.

Q12: Historically,stocks have delivered a _ return on

Q50: A company issues a 20-year,callable bond at

Q58: Which of the following statements concerning the

Q62: What is the principal guiding factor for

Q77: Which type of financial institution receives money

Q82: Stella places a market order with her

Q86: A firm issues $200 million in ten-year

Q100: Under the indirect method of preparing the

Q104: Ford Motor Company is discussing new ways

Q107: The total market value of General Motors