Use the table for the question(s) below.

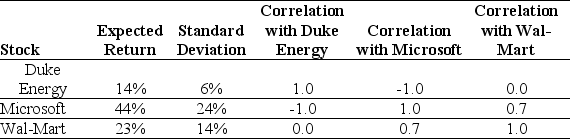

Consider the following expected returns,volatilities,and correlations:

-The expected return of a portfolio that consists of a long position of $10,000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Psychoanalytic Tradition

A school of psychological thought and therapy founded by Sigmund Freud, emphasizing the influence of unconscious thoughts, feelings, and childhood experiences.

Psychodynamic Therapy

Psychodynamic therapy is a form of depth psychology that focuses on revealing and resolving the unconscious conflicts believed to be rooted in childhood experiences, influencing current behavior and feelings.

Insight

The ability to understand the true nature of a situation, especially through intuitive understanding.

Psychotherapies

A range of treatments for mental health issues that involve talking to a psychologist or psychiatrist.

Q2: If the ending inventory balance was overstated

Q19: Rain Forever Corporation had a beginning balance

Q19: Which of the following would be more

Q34: Over 60% of all Canadian business profit

Q36: Streyna Company reported net sales of $95,000

Q78: Phoenix Rising Corporation sold an unused building

Q84: ReNew Corporation had accounts receivable of $90,000

Q93: When computing trend percentages:<br>A)the base year is

Q95: Rain Forever Corporation had a beginning balance

Q98: Stocks that have a higher volatility will