Use the table for the question(s) below.

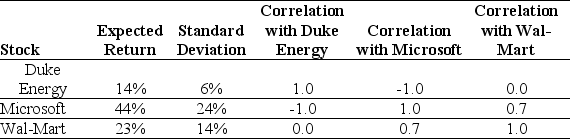

Consider the following expected returns,volatilities,and correlations:

-The volatility of a portfolio that is consists of a long position of $10,000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Definitions:

Significance Level

A statistical measure used in hypothesis testing to determine the threshold at which an observed data point or result is considered to be statistically significant.

Litres Of Water

A measure of volume used to quantify the amount of water, where one litre equals one cubic decimeter.

Conservation Video

Multimedia content created to raise awareness about conserving natural resources and protecting the environment.

Paired T-test

A statistical analysis method that compares the averages of two connected groups to see if their difference is statistically significant.

Q24: A one-year European call option on ABX

Q36: Streyna Company reported net sales of $95,000

Q39: It is generally not the duty of

Q47: Starling Capital has outstanding corporate debt paying

Q56: A put option on a stock has

Q75: When a company writes a call option

Q86: You own 50 units of a real

Q89: All of the following might appear as

Q100: Ivanhoe Energy Inc had realized returns of

Q101: An IPO is offered at $23 per