Use the table for the question(s) below.

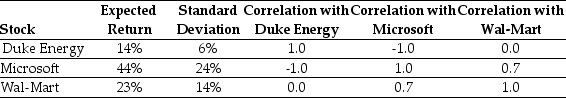

Consider the following expected returns, volatilities, and correlations:

-What is the lowest risk possible by selecting two stocks that are perfectly negatively correlated?

Definitions:

Mean Absolute Deviation

Mean absolute deviation measures the average absolute distances between each data point in a set and the set's mean, providing an overview of variability.

Sum of Squares

A statistical technique used to describe the total variation in a dataset, which is the sum of the squared differences from the mean.

Mean Absolute Deviation

The average of absolute differences between each data point and the mean of the dataset.

Sum of Squares

is a statistical technique used to measure the dispersion or variability within data points.

Q5: Northern Lights Corp.stock trades at $55 per

Q12: An IPO is offered at $9.50 per

Q35: The average annual return over the period

Q40: What is the difference between the effective

Q50: Your portfolio contains $33,000 of CP Rail

Q54: The average annual return over the period

Q59: The expected return is usually _ the

Q94: For large portfolios,investors should expect a higher

Q94: When you purchase a put option while

Q131: Financial leverage exists when a company earns