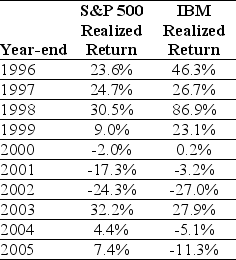

Use the table for the question(s) below.

Consider the following realized annual returns:

-The average annual return on the S&P 500 from 1996 to 2005 is closest to:

Definitions:

Household Income

The total gross income before taxes of all household members over a certain age, typically used for financial assessments.

American Opportunity Tax

A credit that allows taxpayers to reduce their federal income tax based on qualified education expenses paid for themselves, a spouse, or a dependent.

Lifetime Learning Credits

A tax credit available to students enrolled in eligible educational institutions, aimed at reducing tax liability for tuition and certain related expenses.

AGI Amounts

AGI Amounts, or Adjusted Gross Income Amounts, represent an individual's total gross income minus specific deductions, used to determine how much of their income is taxable.

Q30: Potash Corp stock has a beta of

Q31: Partnerships are the most common type of

Q54: The _ side of an options contract

Q56: What are callable bonds?

Q61: Outstanding debt of Home Depot trades with

Q62: A statement of cash flows:<br>A)is typically prepared

Q90: A call option on a stock has

Q102: Assume that the Inventory balance at the

Q105: Stockton-Meadows Incorporated reports an increase in Accounts

Q120: The estimated value of a company's stock